Last updated on December 16, 2025

It should not come as a surprise that all major cyber insurance companies are now requiring MFA. President Biden’s Executive Order on Improving the Nation’s Cybersecurity mandates the use of Multi-Factor Authentication (MFA) across all federal agencies in the United States. Cybercrime is more powerful than ever, and each month, more and more individuals and organizations have to experience this firsthand. Hence, the activities aimed at increasing security through wider adaptation of Multi-Factor Authentication (MFA) across all industries.

Cybercriminals Increasingly Target Financial Data

In the past few years, the Internal Revenue Service (IRS) received an alarming number of reports about tax practitioners becoming victims of data theft and is now urging tax professionals and taxpayers to protect tax software accounts with Multi-Factor Authentication.

In 2021, Financial Services were a common target of ransomware attacks, with the average bill for rectifying a ransomware attack exceeding US$2 million, according to The State of Ransomware in Financial Services 2021.

Unfortunately, ransomware attacks were not the only kind of attacks financial services fell victim to in 2021. Malware, especially mobile device malware, saw a huge increase in 2020. This trend continued throughout 2021. In addition to that, data breach costs reached a record high over the past year.

Multi-Factor Authentication (MFA) Stops Cybercriminals

Multi-Factor Authentication is a cybersecurity standard that every organization should use to protect their user accounts. Using MFA is especially important with tax software products because of the sensitive data held in the software or online accounts.

Identity theft most often happens after the malicious actor manages to compromise an account inside a corporate network, system, or application. The number-one security strategy against identity theft is stopping the attackers before they gain access to the account. If you want to stall the attackers at your door, introduce modern security policies, security controls, and Multi-Factor Authentication to your workforce. Since most attacks start from the malicious actor gaining access to a poorly-secured account, the best way to prevent a data breach is to increase the security of all accounts. Well-protected accounts will improve the security posture of a company.

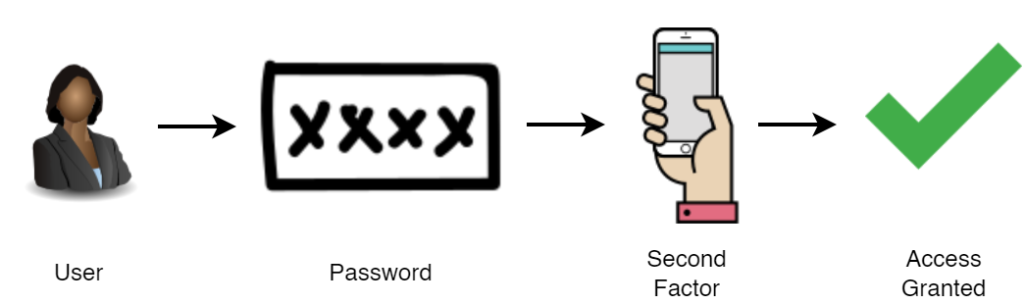

The following diagram portrays a simplified process of MFA using the Mobile Push authentication method:

- User initializes authentication.

- User provides their login and password.

- User receives a Mobile Push authentication request on their phone and accepts the request with just one tap.

- User gains access to their account.

To make it harder for attackers to gain access to accounts, Multi-Factor Authentication introduces one or more extra layers of security called factors. Each factor is independent, and breaking one of them does not affect the others. A malicious actor must break all factors to gain access to the account, which is near impossible with a well-implemented cybersecurity solution.

Usually, Multi-Factor Authentication consists of two steps. First, the security system asks the user to provide their login and password information. Then, if these credentials are correct, the security system asks the user for another proof of their identity. Users can demonstrate this proof using one of several authentication methods. Each authentication method comes with its unique set of pros and cons, but Mobile Push and FIDO are both the most secure and most user-friendly authentication methods.

Security Keys might be the most secure authentication method currently available. Unfortunately, security keys come with the drawback of high cost. Each user must own their personal security key, which might be a costly solution for a company.

On the other hand, the Mobile Push authentication method is free and can be additionally strengthened by a biometric lock on the authenticator mobile app installed on your smartphone, e.g., Rublon Authenticator. When combined with a biometric lock, Mobile Push is almost as secure as security keys, which makes it the most cost-effective MFA solution.

Let Rublon MFA Protect Your Tax Data

It is a well-known fact that tax professionals are required by law to write a data security plan, as is mandated in the new Taxes-Security-Together Checklist created by the IRS and its Security Summit partners. Tax pros must design a program to protect data and then put it in place. They also must have a written contract with their service provider. However, it is the service provider’s responsibility to maintain appropriate safety measures and revise them as needed. In short, selecting a good security service provider is crucial for the security of taxpayers’ data.

Given its high efficiency in fighting off cybercrime, Multi-Factor Authentication is a must-have solution, and the quality of offered MFA solution is a crucial part of choosing a service provider for an accounting firm. Other nice-to-have security measures that can make a service provider stand out from others are Access Policies, Adaptive Authentication, and Single Sign-On (SSO).

If you wish to try out Rublon, you can do so for free by starting the 30-Day Trial.